Futures and Options spread strategies

Read our in-depth guide to F&O spread strategies in online trading and learn valuable insights into risk management and capitalising on market conditions.

Futures and options contracts are financial derivatives that traders use to capture profit from volatility and manage risk

Futures and options spread trading means simultaneously buying and selling several contracts to make profit from price changes in the underlying asset

Covered call, calendar spread and ratio spread are some of the commonly used futures and options spread strategies

Traders using spread strategies should be mindful of transaction costs and margin requirements and always use risk management tools to protect their capital

Introduction to futures and options contracts

Futures contracts are standardised agreements between two parties to buy or sell a financial asset at a predetermined future date and price. The underlying asset can be a commodity, stock index, or other tradable asset.

Each futures contract represents a specific quantity of the underlying asset. The contract size is standardised and varies depending on the type of asset. For example, a gold futures contract may represent 100 troy ounces of gold.

Options contracts are financial derivatives that provide the buyer with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified expiration date. The seller of the option, on the other hand, is obligated to fulfil the terms of the contract if the buyer decides to exercise their right.

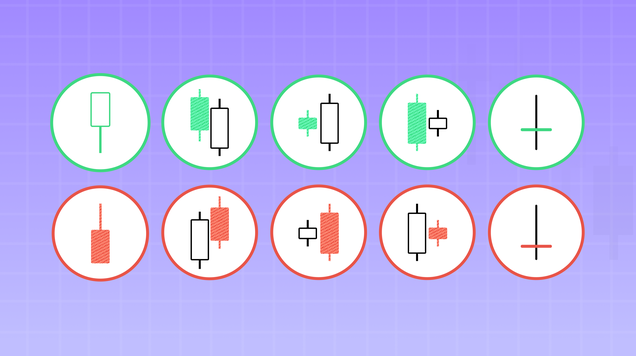

There are two main types of options: call options and put options. A call option gives the holder the right to buy the underlying asset at the strike price before or on the expiration date, while a put option gives the holder the right to sell the asset.

Futures and options contracts are commonly used for various purposes in trading, including price speculation for profit and risk management through hedging and portfolio diversification.

Futures spread trading explained

Futures spread is a strategy used by traders to capitalise on profit opportunities using derivatives tied to an underlying asset. The objective is to benefit from the price differences between two positions by entering into two different futures contracts. Traders often opt for a futures spread on a particular asset when they anticipate gains arising from price volatility.

There are two main types of futures spreads:

Intracommodity spread (Calendar spread): In this type of spread, a trader takes opposite positions in contracts of the same commodity but with different delivery months. For example, buying a corn futures contract for March and selling a corn futures contract for May.

Intercommodity spread (Intermarket spread): This involves trading futures contracts on related but different commodities. For instance, a trader might buy crude oil futures and sell natural gas futures if there is an expectation that the prices of these commodities will move in a certain relationship.

Traders employ futures spreads for various purposes, with risk management being a primary objective. By utilising spreads, traders can hedge against price volatility in specific markets, mitigating potential financial exposure.

Another futures spread strategy is arbitrage, where traders exploit price discrepancies between related contracts or markets to capture profits. While futures spreads are generally considered a more conservative approach compared to outright futures positions, they introduce their own complexities and risks.

Options spread trading explained

Options trading commonly employs calendar spreads, vertical spreads, and diagonal spreads, which utilise combinations of call and put options featuring varying strike prices and expiration dates. These strategies have distinct characteristics and serve specific objectives.

Options spread strategies are designed to manage risk, generate income, and capitalise on specific market conditions. Traders should carefully consider the market outlook, their risk tolerance, and the potential rewards when implementing these strategies. It's essential to thoroughly understand the mechanics of each spread and the potential impact of factors such as time decay, implied volatility, and underlying price movements.

Calendar spread

Also known as a time spread or horizontal spread, a calendar spread means buying and selling options of the same type (either calls or puts) with the same strike price but different expiration dates. The strategy benefits from time decay, as the near-term option tends to lose value more rapidly than the longer-term option.

Vertical spread

A vertical spread, or a price spread, involves buying and selling options of the same type (calls or puts) on the same underlying asset with different strike prices but the same expiration date.

The primary goal of a vertical spread is to benefit from price movements in the underlying asset while controlling risk. There are two main types of vertical spreads:

Bullish vertical spread (Call debit spread): Involves buying a lower-strike call and selling a higher-strike call.

Bearish Vertical spread (Put debit spread): Involves buying a higher-strike put and selling a lower-strike put.

Diagonal spread

A diagonal spread combines options with different strike prices and expiration dates. Typically, it involves buying and selling options with the same type (calls or puts) but different strike prices and expiration dates.

Diagonal spreads offer a balance between the time decay advantage of calendar spreads and the directional exposure of vertical spreads. Traders use diagonal spreads to profit from both price movements and changes in implied volatility.

Futures and options (F&O) spread strategies

Implementing futures and options (F&O) spread strategies involves executing combinations of futures and options contracts to achieve specific trading goals. Here are some common strategies and how to implement them:

- Bull call spread (Vertical call spread):

Objective: Profit from a moderate increase in the price of the underlying asset

To execute a bull call spread, traders buy a call option with a lower strike price while simultaneously selling a call option with a higher strike price. Both options contracts should have the same expiration date, allowing traders to capitalise on upward price movements.

- Bear put spread (Vertical put spread):

Objective: Profit from a moderate decrease in the price of the underlying asset

Traders can implement a bear put spread by buying a put option with a higher strike price and, simultaneously, selling a put option with a lower strike price. Align both options with the same expiration date to take advantage of downward price movements.

- Covered call:

Objective: Generate profit and protect capital against small downside movements in the underlying asset

The covered call strategy involves buying the underlying asset, such as a stock, and simultaneously selling a call option with a strike price above the current market price. Both the stock and the call option should share the same expiration date.

- Iron condor:

Objective: Profit from low volatility in the underlying asset

Traders can implement an ‘iron condor’ by selling an out-of-the-money put option, buying a lower out-of-the-money put option for protection, selling an out-of-the-money call option, and buying a higher out-of-the-money call option for protection. An option is in-the-money if it has intrinsic value, at-the-money if the strike price equals the current market price, and out-of-the-money if it lacks intrinsic value. Ensure that all options involved have the same expiration date.

- Calendar spread (Time spread):

Objective: Profit from time decay and changes in implied volatility.

To execute a calendar spread, traders buy an option with a longer expiration date while simultaneously selling an option with a shorter expiration date. Both options should share the same strike price, allowing traders to capitalise on time decay and volatility fluctuations.

- Ratio spread:

Objective: Capitalise on significant price movements in the underlying asset.

Traders can create a ratio spread by buying a certain number of options and selling a different number of options, introducing a ratio into the strategy. The options can be calls or puts, and they should have the same expiration date.

When trading futures and options spread, traders should be mindful of transaction costs, margin requirements, and the impact of factors like time decay and implied volatility. With proper risk management and strategic implementation, mastering these spread strategies can contribute to a well-rounded trading approach.