The US debt ceiling impasse - a layman's guide

Is the US really prepared to default on its debt?

What is the US debt ceiling?

The US federal debt is the amount of money the federal government owes – ie borrows - for spending on all the goods and services it provides, such as defence, social security, Medicare, overseas expenditures etc. The size of this debt limit is set by Congress, which effectively authorises the total value of funds the US Treasury is allowed to raise via issuing debt securities such as Treasury bills. Increasing, or suspending, this debt ceiling does not necessarily mean that new spending commitments have been authorised; often an increase in the ceiling is required simply to allow the current administration to finance existing legal spending obligations that previous Presidents and Congresses have agreed to in the past. It is because the US has a debt ceiling set at an absolute amount rather than a percentage of GDP which creates this bizarre situation of potentially preventing spending that has already been legislatively enacted.

The need for such Congressional action has been needed some seventy-eight times since 1960, and nearly one hundred times since 1945. While in the past it has been a relatively straightforward exercise, recently it has become much more of a political issue, mirroring the increasingly bi-polar nature of US politics. And the political battle it has now become has costs. In 2011, the deadlock between the Obama White House and a Republican House was sufficient for S&P to downgrade the US credit rating, the first such move in US history. An agreement was ultimately reached allowing Congress to raise the debt ceiling just two days before the US Treasury estimated it would run out of funds. A similar battle was seen in 2021, before protracted negotiations allowed the debt ceiling to be raised to a level that allowed for the continued issuance of debt until January this year. Having met this current debt ceiling, since January the US Treasury has been implementing so called “extraordinary” measures to avoid defaulting on its obligations. But these are simply stop-gap measures, and the Treasury has estimated they will be exhausted this July.

The regular battles over the debt ceiling are very much examples of what the market terms ‘black swan’ events. These are very low-probability, extreme events that are notoriously difficult for the markets to price. For the battles involving the US debt ceiling, market attitudes in the past have tended to be not to bother even trying to assign a value to them. But over the past week this attitude appears to have shifted, suggesting a sense of pessimism this time around that an agreement will not be reached in time to prevent a default.

The current impasse

With time running out to agree a new debt ceiling, House Speaker Kevin McCarthy published a plan this month that allows for a one-year debt ceiling extension worth $1.5trn to be made. But attached to this extension are the requirement for significant cuts to be made to domestic spending programs. The scale of cuts being demanded are considered unlikely to be supported by enough members of his own Republican Party to allow the plan to be approved by the House – where the Republican majority is wafer-thin - let alone to meet the approval of the Democratic-controlled Senate. And on top of this, President Biden has already said that he wants a “clean” extension bill only, ie one that is not tied to any other obligations being met. Currently there are no signs that any of the parties involved are prepared to compromise, leaving the markets fretting about the growing prospect of a US default.

Market reaction

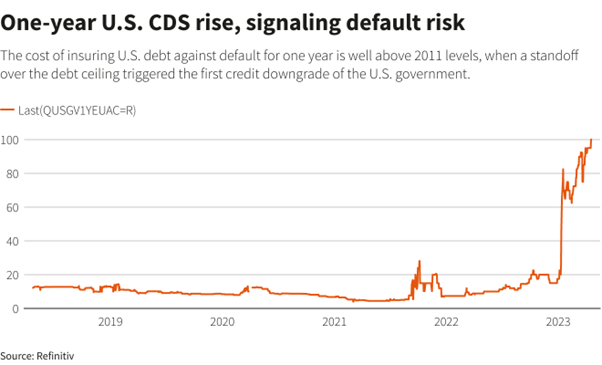

This pessimism is showing up via two main channels. Firstly, CDS spreads on US debt – the cost of insuring against the US failing to repay creditors – have widened to their highest level since the 2008 financial crisis, the 1-yr CDS showing the cost of insuring against a US default over a one-year time horizon rising to over 100bps. This can be seen in the graph below.

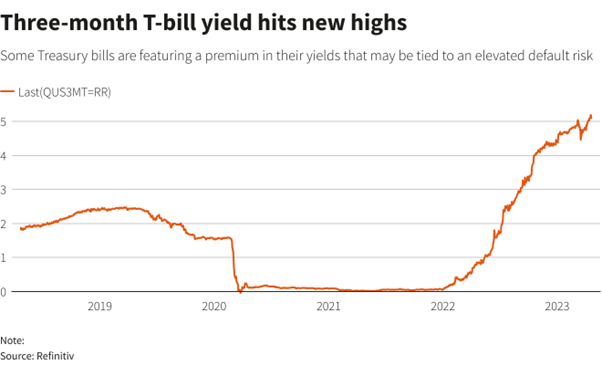

And secondly, as shown below, yields on short term instruments maturing from end-July onwards are rising as investors demand an increasing risk premium to hold instruments that are potentially threatened by a US default. As shown below, yields on 3-mth Treasury bills - the instruments consider to be most at risk from the current impasse - have risen to their highest levels in some 22 years. Conversely, instruments maturing before July are becoming increasingly expensive, their yields falling sharply.

What are the potential implications of a US debt default?

An examination of past debt ceiling crises can offer insights into what we can expect to see as we move closer to July without a new ceiling being agreed, including what the implications of a failure to reach an agreement might mean.

Firstly, the debt ceiling crisis of 2011 triggered a sell off in equities that saw the S&P lose around 15% of its value, while those stocks most closely associated with federal government spending fell by around 25%. Further equity market weakness was seen in 2021 before the agreement on the current ceiling was finally reached, while pricing anomalies in Treasury bills were also seen, very much akin to the movements being seen in T-bill yields now. As July approaches and no agreement is reached, it is reasonable to expect US equity markets to come under similar pressure as seen in 2011 and 2021, with more significant falls accompanying an actual default.

Second, a US default would be extremely negative for the global financial system. US bonds are considered some of the safest investments globally and very much serve as the building blocks of the global financial architecture. But investor confidence in the ability of the US to repay these bonds would be lost, threatening to undermine the very foundations of this architecture.

Third, the US would likely be left with the legacy of a permanent shift upwards in its cost of funding as investors, both domestic and foreign, would demand a higher risk premium for holding US debt. In a similar vein, interest rates globally would exhibit increased volatility given that rates generally are in part influenced and priced off the ‘risk-free’ nature of US government debt.

Fourth, alongside a higher cost of financing debt, increased market volatility can be expected to dent both consumer and corporate sentiment globally, leading to a decline in investment and spending and seeing households start to once again build up precautionary savings. And in the US specifically, the inevitable government shutdown would see federal spending cease, further removing spending power from the economy.

Fifth, overseas investors would likely lose faith in the US, curtailing investment plans and attempting to repatriate money already invested. This would certainly trigger a significant fall in economic output and concomitant rise in unemployment, requiring the Fed to tilt policy away from fighting inflation and back towards supporting growth.

Sixth, as we approached the debt ceiling deadline with no agreement appearing in sight, so a sell-off in US Treasuries can be expected, and which is likely to spread to more vulnerable debt markets, forcing numerous governments around the world to retrench and cut back on spending. This would be particularly worrisome to emerging market economies that are typically more reliant on capital flows for day-to-day funding.

Lastly, US assets would lose their ‘safe haven’ status, seeing their value drop and facilitating a fall in the value of the US dollar.

Will we actually see a US default?

Currently the market still sees the chances of a US debt default as small. But as July edges nearer without a new debt ceiling in place so this perceived risk is rising. Clearly the threat of a default will be used by both sides of Congress in their negotiations, and it is disingenuous to suggest that it is an outcome that any particular politician wants. But what makes this game of political brinkmanship so worrisome is that nobody knows exactly when the US Treasury will run out of money. Although the earliest date is considered July (and extending as late as September), much will depend on tax receipts between now and then – if April’s receipts come in below expectations, the US authorities could suddenly find the debt crisis is upon them.

But in practice, would the US ever really default on its debt? The answer to this question is no, and for the following reasons. Firstly, the US authorities can print money; and second, the Federal Reserve can purchase debt. The consequences of doing either of these things would not be ideal. They would certainly be inflationary and, with the Fed still battling to bring CPI back under control, it would not welcome being forced to intervene in this way. And getting to this stage would also mean a shutdown of government agencies and the cessation in provision of non-essential services, with hundreds of thousands of federal workers effectively furloughed. But they are levers available for ensuring that the US authorities can continue servicing their debt obligations in extremis.

Thus, in reality, the US debt ceiling is very much a piece of political showboating that is staged when one of the two US legislative chambers is controlled by the party in opposition to the President. It provides an opportunity to try and embarrass the fiscal profligacy and irresponsibility of the President and his party, but at the end of the day is nothing more than a grand gesture.

A potential US debt default is a 'black swan' event: very low probability but also very hard to price