EV Industry: The top companies for investors to watch

The electric vehicle industry is predicted to continue to grow, making it an interesting investment opportunity

The EV industry has experienced substantial growth in recent years

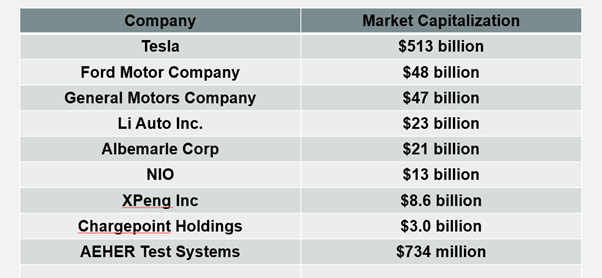

Tesla is considered the pioneer of the EV industry with market cap of $513 billion

NIO Inc., Ford Motor Company and Xpeng Inc. are amongst the other top EV companies using innovative technology and designs

As the industry still has a lot of potential, investors entering the market now have a possibility to benefit from the predicted growth

Overview of the EV industry

The electric vehicle industry is a rapidly growing industry focused on the development, manufacture and deployment of vehicles that run on electricity instead of traditional fossil fuels. They use rechargeable batteries to store energy, providing an alternative to internal combustion engines (ICEs) found in traditional gasoline or diesel vehicles.

In recent years, the electric vehicle (EV) industry has experienced notable growth fuelled by various factors. Growing concerns about climate change, environmental sustainability, and the need to reduce greenhouse gas emissions have spurred both governments and individuals to explore cleaner options for transportation.

In addition, advancements in battery technology, including enhanced energy density and reduced costs, have made electric vehicles increasingly feasible and cost-effective. These combined developments have contributed to the substantial momentum witnessed by the modern EV industry.

The EV industry is characterised by rapid technological advancements, increasing investment, and a shift toward sustainable transportation solutions. It holds the potential to revolutionise the automotive sector, reduce carbon emissions and reshape the future of mobility.

Many countries have implemented policies and incentives to encourage the adoption of electric vehicles, such as tax credits, subsidies and infrastructure investments. This support has helped accelerate the growth of the industry and increase consumer demand for electric vehicles.

Top EV stocks to consider for investing

Tesla, Inc. (TSLA): Tesla is widely recognised as a trailblazer in the modern electric vehicle industry. The company not only manufactures electric cars but also provides energy storage solutions and solar energy products. Tesla's stock has demonstrated remarkable growth, establishing the company as a major player in the EV market.

NIO Inc. (NIO): NIO has gained recognition for producing high-end electric SUVs and sedans. The company's innovative designs and utilisation of advanced battery swapping technology have attracted significant attention in the industry.

Ford Motor Company (F): A renowned American automaker that has made significant strides in the electric vehicle (EV) market. They have introduced several electric models including hybrid cars.

Xpeng Inc. (XPEV): Xpeng is a Chinese electric vehicle manufacturer specialising in smart electric cars with advanced autonomous driving features and innovative technologies.

Why include EV companies in your portfolio?

The inclusion of companies from the electronic vehicle industry in your portfolio has several potential benefits.

Investing in EV-related assets can provide exposure to its predicted growth potential as governments and consumers are increasingly prioritising sustainable transportation solutions.

By including companies involved in EV manufacturing, infrastructure development, or battery technology, investors can diversify their holdings beyond traditional fossil fuel industries and enhance portfolio diversification. Having EV stocks in your portfolio also aligns with investors' ESG (Environmental, Social and Governance) focus.

Investing in the EV industry provides exposure to innovation and technological advancements. It allows investors to tap into cutting-edge technologies such as battery advancements, autonomous driving and energy storage solutions that have broader applications beyond the automotive industry.

Before investing in EV stocks, it's important to consider the volatility and risks associated with the EV sector, as it can be influenced by regulatory policies, technological advancements and competition. Always apply risk management to your portfolio to reduce risk.