Mastering risk management in forex trading

Learn how traders use essential risk management strategies and build discipline in forex trading.

In forex trading, effective risk management is a necessity and distinguishes strategic trading from gambling

Key risk management tools and strategies include position sizing and stop loss and take profit orders

Trades should tailor their risk management plan according to their own risk appetite

Clear trading plan and rules for risk management help trades to stay disciplined especially during high market volatility

Forex trading and risk management

In the volatile realm of forex trading, where fortunes can be won or lost in the blink of an eye, mastering the art of risk management is the key differentiator between calculated trading and reckless gambling. This article delves into the fundamental principles of risk management, exploring strategies and practical examples to navigate the complexities of the forex market.

At its core, risk management serves as the compass guiding traders through the turbulent waters of the forex market. It comprises a set of rules meticulously designed to minimise losses and uphold a judicious risk-to-reward ratio, transforming the act of trading into a strategic pursuit.

Before delving into the strategies, traders must understand their own risk appetite. This means understanding how much capital they can afford to risk without compromising their financial stability. Whether you lean towards the thrill of substantial risks for higher gains or opt for a more conservative approach, this self-awareness sets the foundation for effective risk management.

Aggressive risk takers may stake 3-5% of their account balance per trade, while their risk-averse counterparts might adhere to a more modest 0.5-1.0%. This critical decision sets the stage for a tailored risk management plan that aligns with individual preferences and market conditions.

Crafting effective risk management strategies

Once risk appetite is gauged, the integration of risk management into a trading plan becomes paramount. This involves not only defining the amount to be risked per trade but also planning entry and exit strategies.

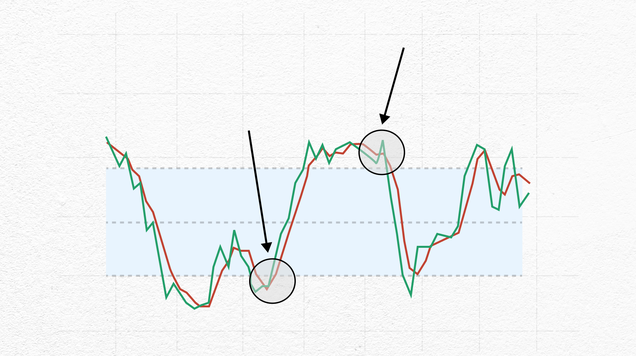

In the forex market, trading without stop loss orders and profit-taking mechanisms is akin to traversing uncharted waters without a compass. Especially new traders are sensitive to siren calls deviating from established rules, hoping losing positions will miraculously reverse. The antidote is well-defined rules and the strategic placement of stop loss orders.

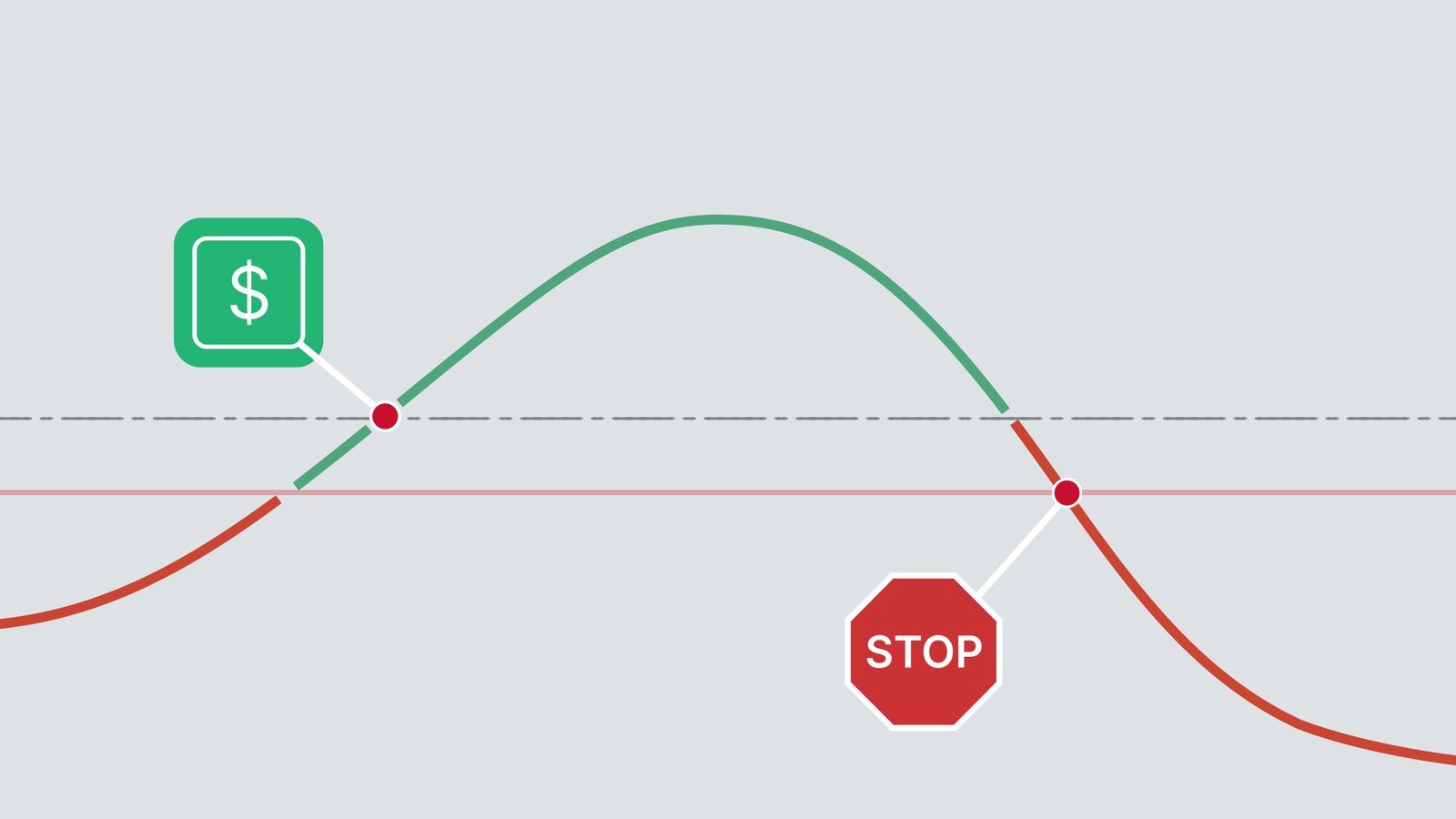

Stop loss order automatically closes a trade at a predetermined level, limiting potential losses. By setting a stop loss order, traders can protect their capital from unfavourable price movements without having to constantly monitor their open position.

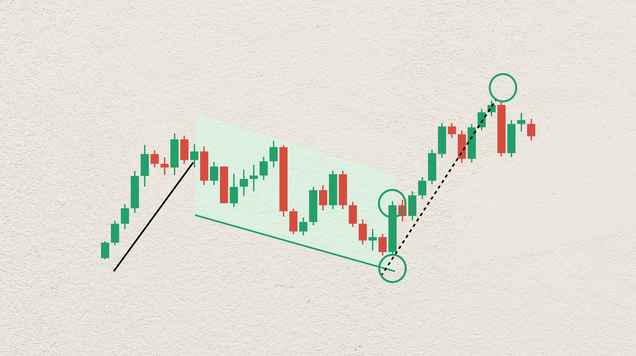

Effective risk management also involves proper position sizing. Traders should avoid using too much leverage, as leverage can amplify both profits and losses. Adhering to a set percentage of risk per trade helps to maintain consistency.

While emotions are inherent in trading, their impact can be mitigated through disciplined practice. A clear trading plan serves as a buffer against impulsive decisions. Realistic expectations further fortify this shield, dissuading traders from pursuing unsustainable gains at the risk of catastrophic losses.

Managing risk: An illustrated example

Let's analyse a hypothetical trade involving the EURUSD pair to illustrate effective risk management in action. Assume a trading account balance of $10,000 and a decision to allocate 2% ($200) for a long position on EURUSD at the 1.0500.

A position size of 50,000 EURUSD is established. Applying the 2% risk rule, the trader is willing to risk $200 on the trade, determining a stop loss placement of 40 pips away from the entry price at 1.0460.

The next crucial step involves setting a take profit order based on a chosen risk-reward ratio. Assuming a 1:2 ratio, where the trader risks $200 to potentially gain $400, the take profit order is positioned 80 pips above the entry point at 1.0580.

In the unpredictable terrain of forex, price movements may elude control, but the trader retains mastery over profit and loss parameters. By strategically aligning stop loss and take profit orders with trading objectives, a robust risk management approach emerges.

It’s important to remember that mastering risk management in forex is an ongoing process and successful risk management requires staying aware what’s happening in the markets. Traders should keep evaluating their risk management strategies and tools to make informed adjustments to their approach if needed.