How to use the Bollinger Bands Indicator

Bollinger Bands: An Introduction and Usage Tips

Identify the direction of the price action and enter the market accordingly

Learn more about how the components of the indicator works

The Innovator of the Bollinger Bands

The innovator of the Bollinger Bands is John Bollinger, who introduced the concept in the early 1980s. Bollinger based his idea on the assumption that the market is in a constant state of flux and remains dynamic, and therefore there must be mobile levels of support and resistance that can predict reversal zones instead of fixed levels.

Type of Indicator

The Bollinger Bands are a directional indicator, and they also measure market liquidity.

Components of the Indicator

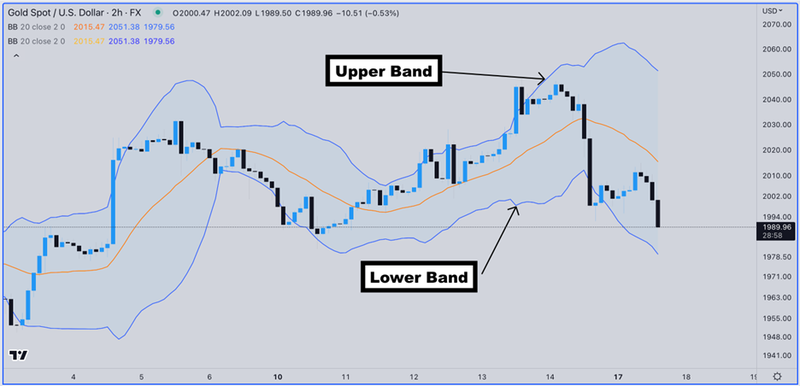

-Middle Band: which is a simple moving average

-Upper Band: which is a positive standard deviation of the simple moving average

-Lower Band: which is a negative standard deviation of the simple moving average

The default settings for the indicator used by John Bollinger are:

- Simple Moving Average of 20 periods

- Positive Standard Deviation of 2

- Negative Standard Deviation of 2

Using Bollinger Bands

1- Using Bollinger Bands as a volatility indicator:

Bollinger Bands provide a clear depiction of the extent of price volatility within the market. When the Bands narrow and converge, it suggests a reduction in the strength of price volatility, frequently followed by a substantial price movement in a specific direction. Consequently, it is advisable to exercise caution when the indicator moves within a confined range and be ready for a powerful movement in a particular direction. Traders should leverage their technical analysis tools to identify the direction of the price movement and enter the market accordingly.

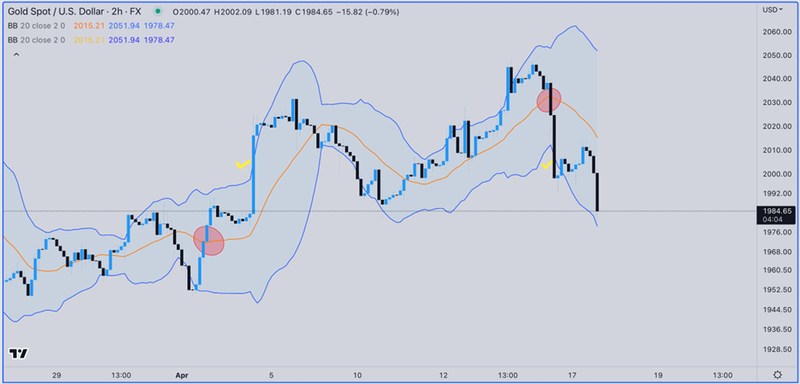

Note the strong movement after the tight range of the indicator.

However, if price volatility increases, the distance between the Bollinger Bands widens, and the price may have reached the peak of its movement, increasing the chances of reversal. Reversal zones can be predicted by combining the Bollinger Bands with momentum indicators.

2- Using Bollinger Bands as targets

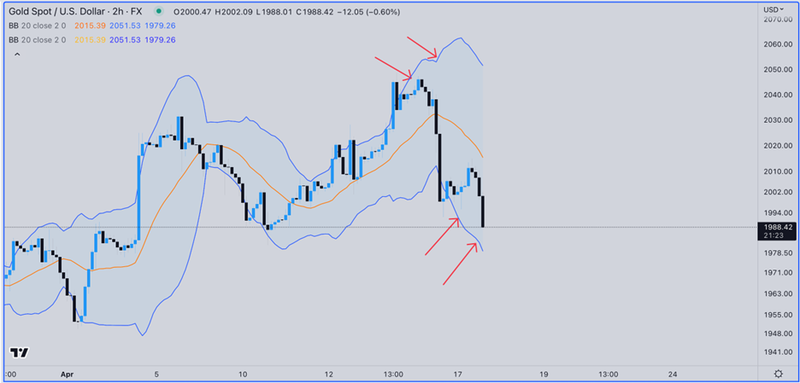

Although the upper limit of the indicator can be considered as resistance and the lower limit as support and used as entry points for trades, it is preferable to use them as targets and not rely on them as entry points to avoid false signals.

Entry can be based on breaking the middle limit - the simple moving average - and the target can be either the upper or lower limit, as in the following example below;