Risk appetite: How it impacts investments and financial markets

Learn how to balance the risk and reward ratio of your investments.

In financial markets, ‘risk appetite’ refers to an investor’s willingness to take on financial risks with the hope of generating profit and is essential for making more informed decisions.

To determine your risk appetite, it’s important to consider your risk aversion (the tendency to avoid risk), your understanding of market volatility (how much objective uncertainty surrounds asset price movements) and how much investment capital you are comfortable to put forward

the level of objective uncertainty surrounding asset price movements.There are many strategies for balancing risk and reward effectively, such as diversification and periodic portfolio rebalancing.

An introduction to risk appetite

The concept of risk appetite is essential for the financial sector, especially when speculating on asset price movements. Broadly speaking, your risk appetite refers to what conditions and outcomes you are willing to accept before investing money on a financial asset.

Understanding risk allows investors to make smarter decisions and more confident investments, although sudden increases in risk premiums, market liquidity declines, and sharp drops in asset prices have often been linked to a loss of risk appetite among investors.

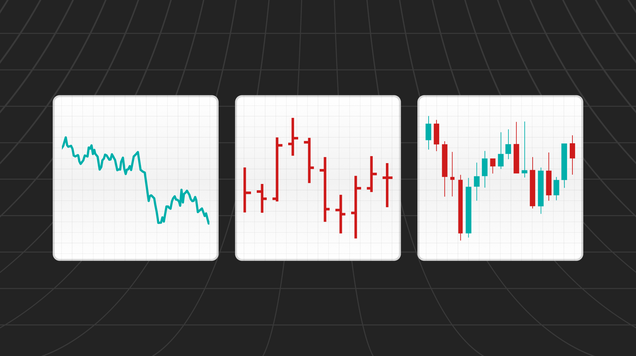

This article takes a deeper look at the concept of risk appetite. We’ll introduce simple risk measurement tools and strategies that can help you balance potential risk in your investments and provide important insights into market movements.

Risk appetite and its influence on asset prices

The terms risk aversion, risk appetite and risk premium are often used interchangeably, but each refers to a distinct concept. It’s crucial to understand their distinct meanings to accurately assess market conditions.

Risk aversion is the tendency to avoid risk. While most investors generally prefer to avoid risk, risk aversion is what measures their subjective attitude towards uncertainty. Because it reflects deep-rooted preferences, risk aversion is assumed to be a constant in asset pricing models.

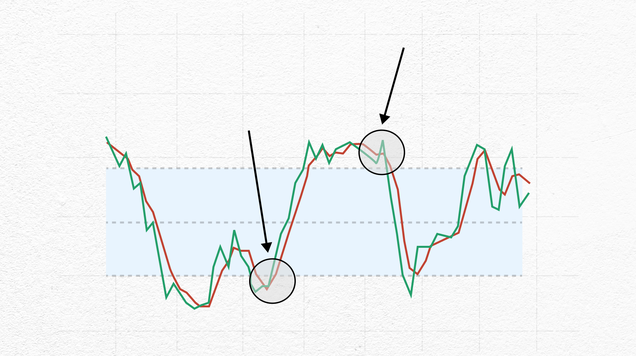

Risk appetite means the level of risk an investor is willing to take. In other words, risk appetites include risk aversion, whilst also considering the level of objective uncertainty surrounding asset price movements. This means that risk appetites are not only influenced by how much investors dislike uncertainty, but also by their perception of fundamental factors that drive asset prices and their associated uncertainty. While neither factor is directly observable from asset prices, risk appetite indices can track changes in investor uncertainty – as risk appetite declines when uncertainty increases.

A higher risk appetite generally implies a greater willingness to invest in riskier assets that offer potentially larger returns. These investors often steer clear of low-risk options, like deposit certificates and fixed interest bank accounts, opting instead for more volatile assets like stocks or forex. While the potential for bigger profits is tempting, volatile assets come with a higher chance of losing their investment and require strategic decision-making to balance risk and reward effectively. Conversely, lower risk appetites often lead investors to seek less volatile assets with lower and slower potential returns, such as bond securities or real estate assets.

Risk premiums are financial indicators that describe how much investors should be repaid for tolerating extra risk, based on the expected return on an investment’s yield in excess of the risk-free rate of return. This provides a form of compensation for investors who take on high risk in the hope of attaining high rewards. Risk premiums embedded in asset prices are also influenced by the level of risk appetite, as well as the riskiness of the asset in question. For example, if a company’s stock is expected to rise by 5% without risk, but investors think it could rise to 8% - the risk premium would be 3%.

Ultimately, measuring risk appetite and its impact on risk premiums and asset prices is crucial for maintaining financial stability. By analysing these factors and developing comprehensive tools to measure them, investors and policymakers can make informed decisions that help mitigate the negative effects of market volatility and uncertainty. However, in times of extreme investor pessimism, the patterns of these measures may not always align, so it’s important to remember there are no guarantees for successful investing.

Strategies to balance risk in decision-making

It’s important for investors to balance the potential returns with the associated risks to achieve their financial goals. Understanding one's risk tolerance is essential in creating a risk management strategy that matches their investment objectives.

However, high or low risk appetites are not the only factors that should be considered when making investment decisions. Investors should also consider their investment horizon, liquidity needs, and overall financial goals. A well-diversified portfolio that balances risk and reward can help to reduce the negative impact of market volatility and fluctuations.

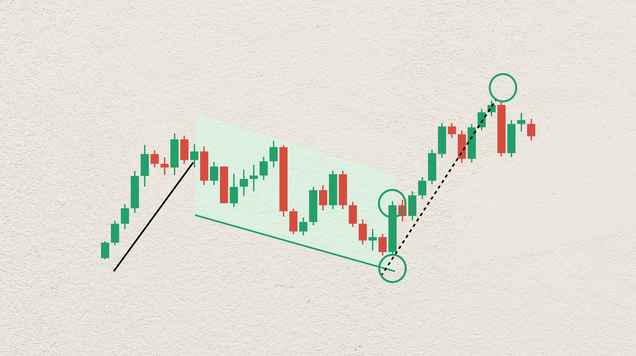

Strategic asset allocation strategy is one approach to achieving this balance. This strategy involves dividing investments among different asset classes, such as equities, bonds and cash, in a way that reflects the investor's risk profile and long-term goals. By diversifying investments across multiple asset classes, investors can reduce the overall risk and maximize their potential for returns. In other words, making lots of smaller investments across different types of products or sectors is a healthier approach than investing all of your capital into one option, as it spreads out the risk distribution.

Another key strategy is to periodically review and rebalance investment portfolios. This involves adjusting the allocation of investments in response to changes in market conditions or the investor's financial goals, and always keeping a close eye on factors that can impact active investments. By regularly rebalancing portfolios, investors can ensure that their investments remain aligned with their long-term objectives and risk profile and optimise risk strategies as markets evolve.

Risk appetite is the compass that guides traders, determining their willingness to seize opportunities for profit