Japanese yen rises amid US banking crisis

the USD/JPY pair has declined to 130.50

The rise of the Japanese yen is due to its status as a safe haven in times of crisis

The decline of the US dollar contributes to the rise of the Japanese yen

The Japanese yen has risen by more than 5% since the beginning of this month

The Main Reasons for the Decline of the USD/JPY Pair

Completing a series of declines that have hit the US dollar against the Japanese yen, the USD/JPY pair has experienced a decline, currently trading near the 130.000 Japanese yen level. This recovery of the Japanese yen is due to market panic caused by the crises affecting the banking sector in recent times. The yen's reputation as a safe haven has reinforced its upward momentum. In addition, the Japanese banking sector is currently experiencing more stability compared to Europe and the United States.

Therefore, the decline of the USD/JPY pair is primarily due to the rise of the Japanese yen. This rise is attributable to several factors, including its reputation as a safe haven currency and the decline of the US dollar. The Japanese yen has risen by more than 5% since the beginning of this month, a trend that is expected to continue as long as the crises affecting the banking sector persist.

Technical and Future Outlook for the USD/JPY Pair

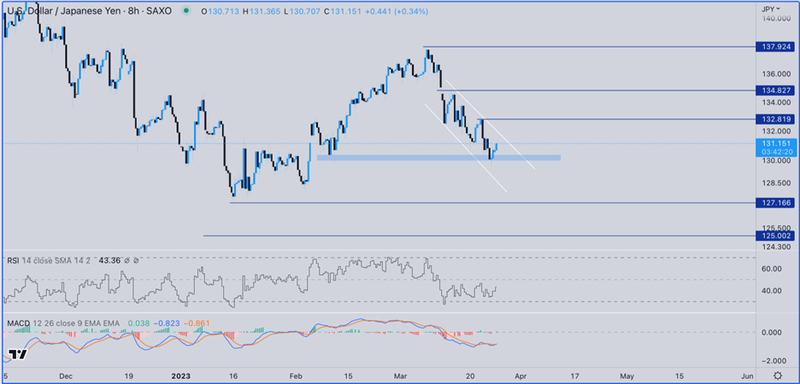

The USD/JPY pair achieved a peak for the year in early March at the 137.90 level, but soon resumed its downward trend due to the crisis in the US banking sector. This crisis significantly contributed to the decline of the pair to the 130.00 level, a decline of more than 5%. Although the pair rebounded to the 131.00 level, it is still moving within a downward channel and is likely to continue declining to test the support level of 129.50. If prices break below this level and remain below it, the decline may extend further to test the support level of 127.50, which could result in a decline to 125.00 points.

However, if the pair manages to maintain support at 130.00 and test the resistance level of 132.50, and if this level is broken, it may change the negative outlook for the pair. In this scenario, we may see further upward movement to the 134.00 level and beyond, with a possible extension of the upward movement to test the peak of this year around 137.90.

In conclusion, the technical and future outlook for the USD/JPY pair suggests a continuation of its downward trend due to the crisis in the US banking sector. However, if the pair manages to maintain support at 130.00 and break through the resistance level of 132.50, there may be an opportunity for upward movement.