How to build a successful forex trading strategy

Read our guide to find out how to create a strong forex trading strategy by balancing psychological insights with technical indicators.

Navigating the highly liquid forex market requires a carefully crafted trading strategy

First step in building a trading strategy is understanding your own personality, emotional reactions, and risk tolerance

Choosing technical indicators that match their objectives and psychological mindset help traders to analyse potential profit opportunities without getting overwhelmed

It’s important to keep testing your chosen strategy, keep a trading journal and adjust your strategy if your goals or market conditions change

Importance of building a forex trading strategy

Forex market is the largest and most liquid financial market globally, offering traders numerous opportunities to profit from the price movements of major, minor, and exotic currency pairs.

Whether you are a beginner or an experienced trader, a well-thought-out trading strategy is the key to success in forex trading. A trading strategy is a tool that provides you with a set of rules to help you make decisions about when to enter or exit trades and how to manage risk. A strategy tailored for currency markets is required to make the most of its profit opportunities while managing risks effectively.

Forex trading strategy is not just about choosing the right indicators but also understanding the psychology behind those choices. A successful strategy for currency traders is a combination of technical expertise, discipline, and adaptability to market conditions.

In this comprehensive guide, we'll delve into how to construct a forex trading strategy that not only leverages technical indicators but also aligns with your psychological profile as a trader.

Psychological foundation of forex trading

At the core of every trading decision lies the trader's psychological mindset. Understanding your emotional responses to wins and losses, stress tolerance, and decision-making process under pressure is crucial.

This self-awareness is the first step in developing a strategy that you can stick with, even in volatile markets. It's about knowing whether you're better suited for the fast-paced world of day trading or the more measured approach of swing trading. Your psychological traits should dictate the trading style you adopt, ensuring a comfortable fit that keeps emotional turmoil at a minimum.

A successful strategy is not just about the technical setup but also about psychological flexibility. Being able to adapt to changing market conditions and recognising when your emotions are influencing your decisions negatively is key. This might mean taking a break after a series of losses or revaluating your strategy if it no longer aligns with your psychological comfort zone.

Choose technical indicators that match your preferences

Technical indicators are tools that can help predict future market movements based on past patterns and analysing historical price data. They are mathematical calculations based on the price, volume, or open interest of an asset. Displayed as patterns on charts, technical indicators serve as visual cues that help traders to analyse and predict market movements.

With dozens of indicators available, the key is to select those that resonate with your trading psychology. For instance, if you prefer a straightforward, clean chart, you might lean towards moving averages or RSI (Relative Strength Index). Conversely, if you're detail-oriented, complex indicators like Fibonacci retracements or Ichimoku clouds could be more your style.

The goal is to choose indicators that not only provide useful insights but also don't overwhelm or confuse you, playing into your psychological strengths.

Building your strategy: A step-by-step guide

Now let’s look at the key elements of building the right forex trading strategy for you.

Define your trading goals: Start with setting clear objectives for your trading journey. Are you seeking steady income or are you more interested in capital growth? Your goals will influence the risk-reward ratio that's acceptable to you.

Assess your risk tolerance: This is where psychology plays a significant role. Once you know how much volatility you can handle comfortably, you can set stop-loss orders and decide how much of your portfolio to risk on individual trades.

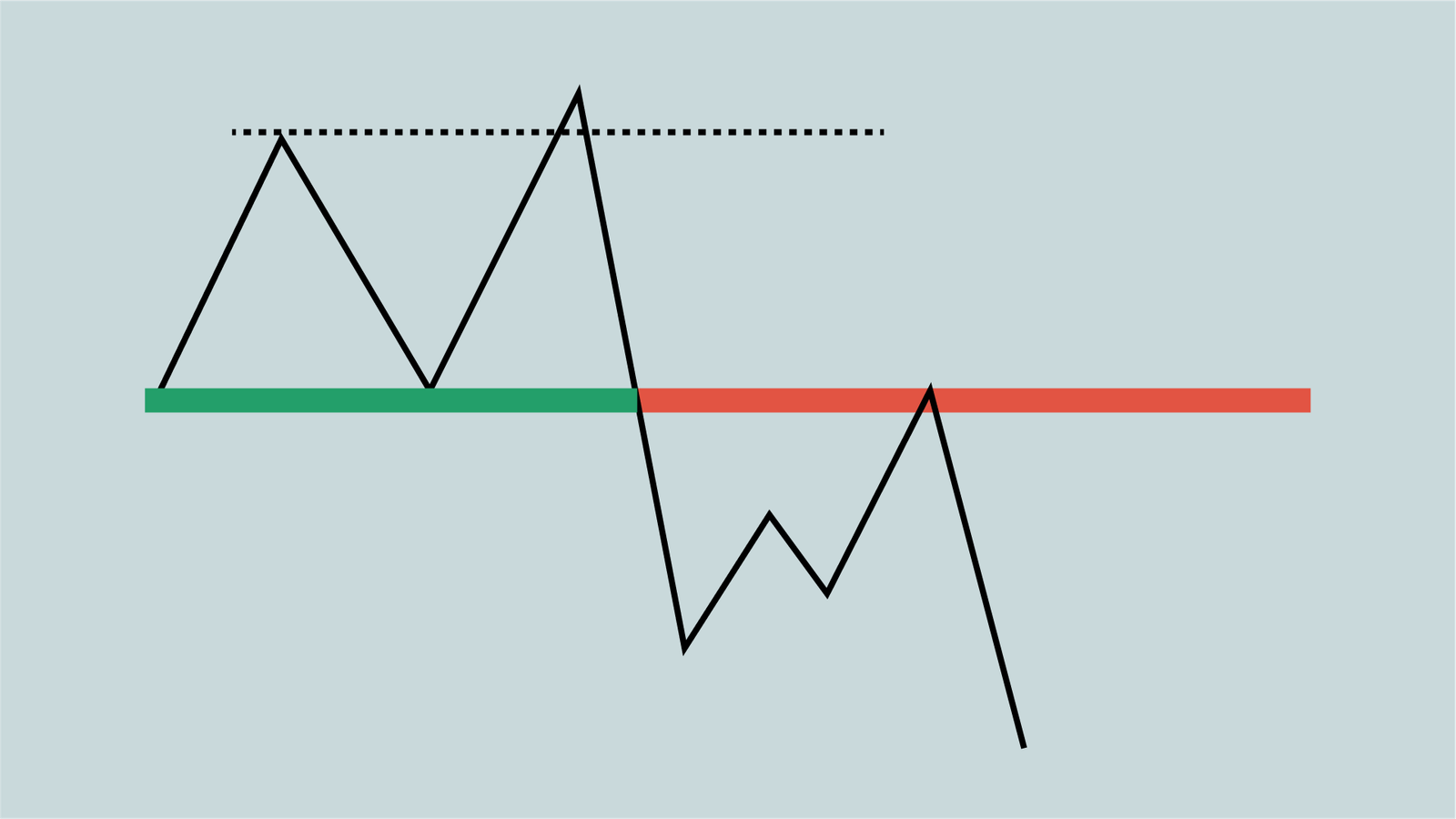

Select your technical indicators: Based on your psychological profile and trading goals, choose a set of primary and secondary indicators. Primary indicators might signal entry and exit points, while secondary indicators can confirm trends or signal potential reversals.

Backtest your strategy: Before going live, simulate your strategy using historical data. This step is crucial for understanding how your strategy performs under different market conditions.

Keep a trading journal: Documenting your trades, including the emotional reasoning behind them, can provide insights into how your psychology affects your trading decisions.

Review and refine: Regularly review your strategy and trading journal. Look for patterns where your emotions led you astray and adjust your strategy accordingly.

It’s important to remember that long-term success in currency trading requires continuous improvement and you might need to test and adjust your strategy several times before finding the right approach for your needs.