Limited declines observed in GBP/USD pair since start of the week

Markets anticipate bank of England meeting on Thursday

Despite the correction in the GBP, it continues to maintain an upward trend

There are expectations of a 25-basis point increase in the interest rate on the GBP

The markets are currently focused on the outcome of tomorrow's Bank of England meeting, which is scheduled for Thursday

Anticipated events with potential impact on GBP movement tomorrow

After a series of gains against the USD, the GBP has experienced limited declines since the beginning of the week, leading up to the Bank of England meeting scheduled for tomorrow, Thursday. The purpose of this meeting is to discuss the appropriate monetary policy for the UK economy. Today, the GBP opened trading with a decline against the USD, and the currency pair is currently trading near the level of 1.2614 USD.

Given the recent positive data in the UK, particularly in the housing market, there is a growing expectation that the Bank of England will once again raise the main interest rate by 25 basis points, resulting in a final interest rate of 4.50%.

Market participants will closely monitor the policy statement and the statements of Bank Governor Andrew Bailey, seeking clear evidence of the Bank of England's ongoing commitment to combating high inflation in the UK.

Earlier, Deputy Governor of the Bank of England, Ben Broadbent, stated that if the bank had raised interest rates six months ago, it could have reduced the peak of inflation by up to half a percentage point. He emphasized that any future increase in inflation rates would prompt the bank to tighten monetary policy more rapidly.

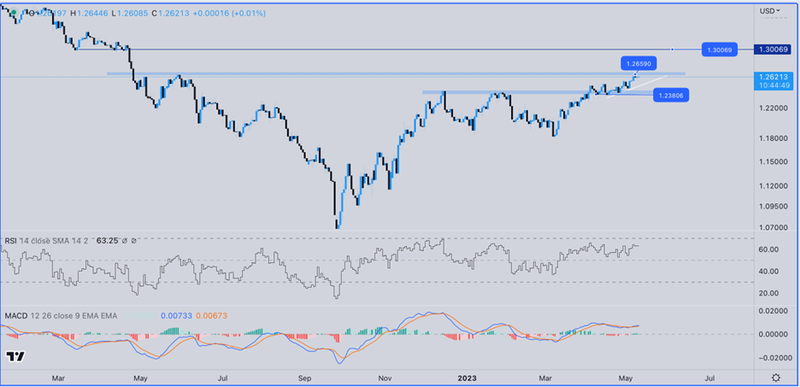

The key technical levels that may influence GBP movements

After successfully reaching the resistance level of 126.60, the GBP/USD pair failed to surpass it and retraced to trade around the level of 126.20. If it fails to break the resistance level of 126.60, a correction could occur, potentially testing the support level of 1.2580. In the event that this level is breached, the decline may extend to the level of 124.40, which serves as the support level for the upward trend line. Maintaining this level is crucial to demonstrate the commitment to continuing the upward trend.

On the other hand, if the pair manages to break the resistance level of 126.60 and remains above it, it could contribute to further upward movement, potentially testing the levels of 128.00. Surpassing this level may lead to a rise towards the level of 130.00.