Technical analysis: Chevron and Exxon Mobil

The energy sector in a cost rising environment

Chevron underperforms its relative benchmark the S&P 500

Germany serves as a prominent example of the severe consequences of energy crises, including economic overheating followed by recession

The global recession fears emerged as a significant factor, swiftly altering the trajectory of the oil market

Navigating Energy Crises and unveiling the impact on the energy sector

In the ever-evolving energy landscape, the sector finds itself grappling with a confluence of challenges. High inflation, geopolitical tensions, and reduced demand from the world's largest oil consumer have left a significant imprint on the industry, triggering severe consequences. With Germany at the forefront, experiencing economic overheating followed by recession, it becomes crucial to explore the implications of these factors on the energy sector.

The abrupt surge in energy costs has placed immense strain on budgets, causing a decline in disposable income and driving up production expenses. Consequently, consumer spending has dwindled, leading to lower business profitability and an overall slowdown in the economy. These challenges, stemming from energy-related issues, can even have ripple effects, potentially triggering broader economic downturns and recessionary conditions that reverberate across multiple industries.

While China's reopening since the end of 2022 has brought about a wave of optimism, the spikes in oil prices and demand were short-lived. The global recession fears emerged as a significant factor, swiftly altering the trajectory of the oil market and the energy sector. The interplay between China's economic recovery and the prevailing global recessionary climate has introduced an additional layer of complexity to the energy sector, necessitating careful observation and analysis.

Let’s take a look at energy stocks during this time.

Chevron Stock Technical Analysis

Chevron, one of the largest crude oil companies with $293.03 billion-market cap reported better-than-expected first-quarter earnings, surpassing market forecasts. The company's adjusted earnings stood at $6.7 billion, compared to $6.5 billion in the previous year supported by stronger global refining margins. Focus will now be on the second quarterly earnings by the end of July.

Fundamentally, the company has experienced some equity sell off and has underperformed relative to the S&P 500.

According to seeking Alpha the stock has underperformed in the price return by -11.90%.

On the daily time frame: it has been following a downward trend since end of April 2023 despite OPEC+ production cuts to rebalance oil prices. The trend started following weak Chinese demand for oil and weak economic data, signifying intense worries about China’s recovery after 2 years of lockdown.

China’s trade balance has marginally dropped from 618B to 452B. Leading a very sour sentiment for the week.

On the weekly time frame: as shown below, the stock was unable to break above $172, a very strong resistance point because of recession challenges. Any downside break of levels of $150 could lead to a further downside extension near $142.

On the upside, considering the upcoming July earnings report, if proven positive it could potentially create momentum for Chevron's stock price to surpass the $160 mark, Although the possibility of a recession worries fading away in the near future is unlikely and could cap gains for the stock even further.

Exxon Mobil Stock Technical Analysis

ExxonMobil is one of the world's largest publicly traded multinational oil and gas companies. The mega cap company has been subject to intense volatility due to OPEC and its allies continuous intervention on oil prices and unexpected crude oil inventories build up.

Financial results for Q1 2023 indicated a decline compared to the previous quarter, with a 12% decrease in revenue and a slight drop in share price. This deterioration can be attributed to lower oil prices and heightened competition in the energy sector. As a result, there may be a potential impact on the company's dividend pay-outs, with a possibility of slower growth or the need to borrow in order to maintain them.

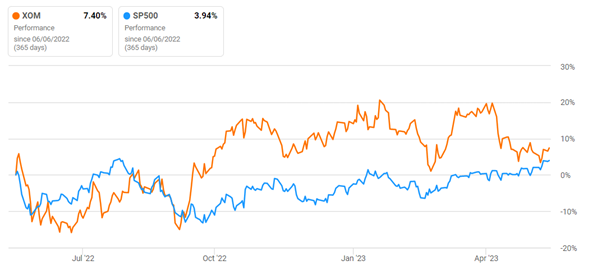

Although the price return overperformed than the S&P 500 by 7.40% whilst the S&P scores 3.94%.

On the daily time frame: There has been a wide range of gaps in the stock price due to intense bets on the price ranging from $100 to $108 and high volatility particularly relative to the oil market. Despite these gaps, prices are trying to build up a sideway trajectory with prices now stabilizing near $106.

On the weekly time frame: The trend is trying to resume a sideway range after dropping from its April peak near $118, to trade in a tight range between $102 and $106.

In summary, both Chevron and Exxon Mobil stocks have faced significant volatility due to various factors, including the impending recession, lower-than-expected data from major oil consumers, and selling pressure from prominent institutions. These conditions may create opportunities for selling positions for Chevron. However, it is important to note that upcoming earnings reports will serve as a crucial catalyst for the movement of these stocks' prices.